| Date | |

|---|---|

| Author | DCM |

In November 2018, DCM launched Mission 16-34: Launch, Land, Impact, the fourth instalment of the Building Box Office Brands research series. One of the primary findings uncovered is that cinema fulfils a unique role in the lives of 16-34 year olds. With the help of the latest data from FAME (Film Audience Measurement & Evaluation – the cinema industry’s tool for analysing film viewing and cinemagoing behavior), DCM’s Insight Executive, Rob Attwood, further explores this topic.

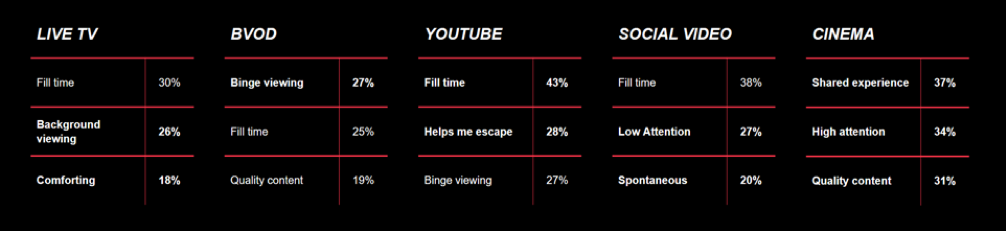

In Mission 16-34, cinema resonated with the audience as being as a ‘shared experience’ (37%) that demands ‘high attention’ (34%) and provides ‘quality content’ (31%). Neither ‘shared experience’ nor ‘high attention’ were associated as highly for any of the other AV formats (TV, broadcaster VOD, social video, YouTube) - cinema providing something increasingly unique for viewers (and advertisers) alike.

In addition to the Building Box Office Brands series, DCM (alongside Pearl & Dean) run the annual, comprehensive FAME survey. Questions cover a broad range of areas, from how cinemagoers travel to the cinema, to what they buy in foyer, to where they go after the film has finished. The results provide the industry with actionable insights that inform both cinema and wider media planning. With the latest data in from the 2018 survey, let’s take a further look at cinema’s unique role in the lives of 16-34s.

1. Cinema is a shared experience

Primarily, cinema is a social experience for 16-34s with 93% of their cinema visits shared with another person, and they’re 21% more likely than the average cinemagoer to visit in a group of 3 or more (1). Advertisers can benefit from this - in The Choice Factory, Richard Shotton (Founder of Astroten; former Head of Behavioral Science at MGOMD) outlines how brands should prioritize group viewing moments, helping them land humorous messaging and drive emotional brand metrics more effectivley (2) . Advertising viewed together with others is more impactful; the group dynamic evokes a heightened emotional response meaning funny messages become funnier and sad messages become sadder (2).

2. Cinema demands high attention

In a world of multi-screening and 3-second views, it is hard to argue that any another AV format demands higher attention than cinema. The big screen’s ability to engage its audience is one of the medium’s greatest strengths. In fact, compared to when using the internet, 16-34s are 38% more likely to feel attentive and 64% less likely to feel distracted when watching a film at the cinema (1).

Cinema audiences are engaged and receptive, a state rightly attributed to the dark room, giant screen and all-encompassing sound. The very nature of the blockbuster further enhances this - highly-anticipated, must-see-first, cannot-watch-anywhere-else content. Take Avengers: Endgame for example, Disney’s latest box office groundbreaker. The culmination of a decade long narrative attracted 3.2m 16-34s in its opening seven days (3) (a whopping 21 TVRs). This audience drive the box office by watching latest releases as soon as possible - of cinemagoers to watch a preview (the first night a new film is available at the cinema) a resounding 73% fall within this age group (1).

3. Cinema is the home of quality content

Whether it’s jaw-dropping action, incredible animation or a feel-good musical, cinema is synonymous with showcasing content of the highest quality. With audiences at their highest since 1970 and over 900 releases a year there really is something for everyone. Yet in recent years questions have been raised on the proliferation of streaming services and its effect on the cinemagoing of 16-34s.

However, having instant access to great content is only fueling their passion for cinema - 95% of 16-34s who have used a streaming service in the last month are also cinemagoers, 12% higher than those that have not used a streaming service (4).

With a plethora of blockbusters and critically acclaimed films released every year, exhibitors have launched subscriptions services of their own (e.g. Cineworld Unlimited, ODEON Limitless) which have appealed to the 16-34 audience. They are 67% more likely than the average cinemagoer to pay a monthly fee for their cinemagoing, with subscriptions having increased 38% over the last year (5).

This appetite for cinemagoing is indicative of how it continues to fulfil a unique role in the lives of 16-34s and the enjoyment they get from the shared experience of watching top quality films with others, with no distractions. This is set to continue through 2019 with a host of early-anticipated releases including It: Chapter Two, Joker and Star Wars: The Rise of Skywalker.

For more information on FAME and annual subscription costs please contact Rob.Attwood@dcm.co.uk.